Let’s explore the Gold Standard (1866 – 1881).

Let’s explore the Gold Standard (1866 – 1881).“Right after the Civil War there was considerable talk about reviving Lincoln’s brief experiment with the Constitutional monetary system. Had not the European money-trust intervened, it would have no doubt become an established institution.”

W.Cleon Skousen.

Even after his death, the idea that America might print its own debt free money set off warning bells throughout the entire European banking community.

On April 12th in 1866, the American congress passed the Contraction Act, allowing the treasury to call in and retire some of Lincoln’s greenbacks. With only the banks standing to gain from this, it’s not hard to work out the source of this action.

To give the American public the false impression that they would be better off under the gold standard, the money changers used the control they had to cause economic instability. This in turn panicked the people.

And, it was fairly easy to do, too. The Banks simply called in existing loans and refusing to issue new ones. A tried and proven method of causing depression. Then they would spread the word through the media of the day (that they largely controlled) that the lack of a single gold standard was the cause of the hardship.

Meanwhile they simply used the Contraction Act to lower the amount of money in circulation. It went from

$1.8 billion in circulation in 1866 allowing $50.46 per person, to $1.3 billion in 1867 allowing $44.00 per person, to $0.6 billion in 1876 making only $14.60 per person and down to $0.4 billion only ten years later leaving only $6.67 per person… all while there was a continually growing population.

Most people believe the economists when they tell us that recessions and depressions are part of the natural flow.

Most people believe the economists when they tell us that recessions and depressions are part of the natural flow.Sound recently familiar?

But in truth, the money supply is controlled by a small minority who have always done so and will continue to do so if we let them.

By 1872 the American public was beginning to feel the squeeze. So the Bank of England, scheming in the back rooms, sent Ernest Seyd, with lots of money to bribe congress into demonetising silver.

Ernest drafted the legislation himself, which came into law with the passing of the Coinage Act, effectively stopping the minting of silver that year. Here’s what he said about his trip, obviously pleased with himself:

“I went to America in the winter of 1872-73, authorised to secure, if I could, the passage of a bill demonetising silver. It was in the interest of those I represented – the governors of the Bank of England – to have it done. By 1873, gold coins were the only form of coin money.”

Ernest Seyd

Or as explained by Senator Daniel of Virginia:

“In 1872 silver being demonetized in Germany, England, and Holland, a capital of 100,000 pounds ($500,000.00) was raised, Ernest Seyd was sent to this country with this fund as agent for foreign bond holders to effect the same object (demonetization of silver)”.

Senator Daniel of Virginia, May 22, 1890, from a speech in Congress, to be found in the Congressional Record, page 5128, quoting from the Bankers Magazine of August, 1873

Within three years, with 30% of the work force unemployed, the American people began to harken back to the days of silver backed money and the greenbacks. The US Silver Commission was set up to study the problem and responded with telling history:

“The disaster of the Dark Ages was caused by decreasing money and falling prices… Without money, civilisation could not have had a beginning, and with a diminishing supply, it must languish and unless relieved, finally perish. At the Christian era the metallic money of the Roman Empire amounted to $1,800,million. By the end of the fifteenth century it had shrunk to less than $200,million. History records no other such disastrous transition as that from the Roman Empire to the Dark Ages…”

United States Silver Commission

While they obviously could see the problems being caused by the restricted money supply, this declaration did little to help the problem. In 1877, riots broke out all over the country. The bank’s response was to do nothing except to campaign against the idea that greenbacks should be reissued.

The American Bankers Association secretary James Buel expressed the bankers attitude well in a letter to fellow members of the association. He wrote:

“It is advisable to do all in your power to sustain such prominent daily and weekly newspapers, especially the Agricultural and Religious Press, as will oppose the greenback issue of paper money and that you will also withhold patronage from all applicants who are not willing to oppose the government issue of money. To repeal the Act creating bank notes, or to restore to circulation the government issue of money will be to provide the people with money and will therefore seriously affect our individual profits as bankers and lenders. See your congressman at once and engage him to support our interest that we may control legislation.”

From a circular issued by authority of the Associated Bankers of New York, Philadelphia, and Boston signed by one James Buel, secretary, sent out from 247 Broadway, New York in 1877, to the bankers in all of the States

What this statement exposes is the difference in mentality between your average person and a banker. With a banker ‘less really is more’ and every need is simply an opportunity to exploit.

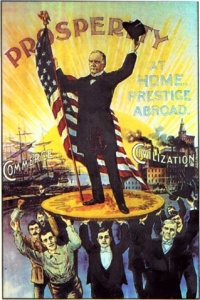

James Garfield became President in 1881 with a firm grasp of where the problem lay.

“Whosoever controls the volume of money in any country is absolute master of all industry and commerce… And when you realise that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.”

James Garfield 1881

Within weeks of releasing this statement, President Garfield was assassinated. Convenient?

The cry from the streets now was to “Free Silver!”